Compound interest is a powerful concept that can have a profound impact on the growth of your investments over time. Whether you’re saving for retirement, a down payment on a home, or any other financial goal, understanding how compound interest works is crucial for maximizing the returns on your invested capital.

In this comprehensive blog post, we’ll delve into the mechanics of compound interest, explore how it can accelerate your investment growth, and provide practical tips on leveraging this powerful financial principle to achieve your long-term financial objectives.

What is Compound Interest?

Compound interest is the interest earned on interest. It’s the process by which an investment’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This reinvestment of earnings creates a snowball effect, where the investment’s value grows exponentially rather than linearly.

To illustrate this concept, let’s consider a simple example. Imagine you invest $1,000 at an annual interest rate of 5%. In the first year, you would earn $50 in interest (5% of $1,000). In the second year, you would earn interest not only on the original $1,000, but also on the $50 you earned in the first year. This means you would earn $52.50 in interest (5% of $1,050). This process continues, with each year’s interest being added to the principal, resulting in a larger base for the next year’s interest calculation.

The Power of Compound Interest

The true power of compound interest lies in its ability to exponentially grow your investments over time. As your investment balance grows, the amount of interest earned each year also increases, leading to an accelerated accumulation of wealth.

Let’s consider another example to illustrate this point. Imagine you invest $10,000 at an annual interest rate of 8%. If you leave the investment untouched for 30 years, your initial $10,000 investment would grow to a staggering $100,767. This is the result of compound interest working its magic over the course of three decades.

Now, let’s compare this to a scenario where you simply earn 8% interest annually without the power of compound interest. In this case, your $10,000 investment would only grow to $46,610 over the same 30-year period. The difference between the two scenarios is a testament to the transformative power of compound interest.

The Importance of Time and Consistency

The longer you can leave your investments to compound, the more significant the growth will be. This is why it’s crucial to start investing as early as possible and maintain a consistent investment strategy.

Consider the following example:

- Person A starts investing $5,000 per year at age 25 and continues until age 65, earning an 8% annual return.

- Person B starts investing $5,000 per year at age 35 and continues until age 65, also earning an 8% annual return.

Even though both individuals invested the same amount of money ($200,000), Person A, who started 10 years earlier, would end up with a significantly larger investment balance of $1,176,610, compared to Person B’s $592,742. The additional 10 years of compound growth made a substantial difference in the final outcome.

This example highlights the importance of starting to invest as early as possible and maintaining a consistent investment strategy. The longer your money has to compound, the more dramatic the results will be.

Factors Affecting Compound Interest

Several factors can influence the growth of your investments through compound interest:

- Interest Rate: The higher the interest rate, the faster your investment will grow. Seek out investment opportunities with the highest possible interest rates, while still aligning with your risk tolerance and investment objectives.

- Compounding Frequency: The more frequently interest is compounded, the faster your investment will grow. Some investments, such as savings accounts, may compound interest daily, while others may compound monthly or annually.

- Time Horizon: The longer you can leave your money invested, the more time compound interest has to work its magic. Resist the temptation to withdraw your investments prematurely, as this can significantly impact your long-term growth.

- Initial Investment: The larger your initial investment, the more capital you have working for you from the start. Even small, regular contributions can add up significantly over time thanks to compound interest.

- Reinvestment of Earnings: Ensure that you reinvest any interest, dividends, or capital gains earned from your investments. This allows the compounding process to continue uninterrupted.

Strategies for Maximizing Compound Interest

To make the most of compound interest, consider implementing the following strategies:

- Start Investing Early: As mentioned earlier, the earlier you start investing, the more time your money has to compound. Even small, regular contributions can snowball into substantial sums over the long run.

- Automate Your Investments: Set up automatic transfers from your bank account to your investment accounts. This ensures that you consistently contribute to your investments, taking the guesswork and temptation to skip a month out of the equation.

- Diversify Your Portfolio: Spread your investments across different asset classes, such as stocks, bonds, and real estate. This can help mitigate risk and ensure that your money is working hard for you in various sectors.

- Minimize Fees and Expenses: High investment fees and expenses can significantly erode the compounding power of your investments. Seek out low-cost index funds, exchange-traded funds (ETFs), and other investment vehicles with minimal fees.

- Reinvest Dividends and Interest: As mentioned earlier, reinvesting any earnings from your investments is crucial for maximizing compound growth. Avoid the temptation to withdraw these earnings and instead, let them continue to work for you.

- Consider Tax-Advantaged Accounts: Investing in tax-advantaged accounts, such as 401(k)s, IRAs, or Roth IRAs, can further boost the power of compound interest by shielding your investments from taxes.

Ready to take control of your finances? Visit upgrade.com now to explore a range of financial products, including Personal Loans, Auto Refinance Loans, Home Improvement Loans, Personal Credit Lines, and Upgrade Card. Let Upgrade help you achieve your financial goals today!

Real-World Examples of Compound Interest

To better understand the practical implications of compound interest, let’s look at some real-world examples:

- Retirement Savings: Compound interest is a crucial factor in building a robust retirement nest egg. Imagine a 25-year-old who invests $5,000 per year in a retirement account earning an 8% annual return. By the time they reach age 65, they would have accumulated over $1 million, thanks to the power of compound interest.

- College Savings: Parents who start saving for their child’s college education early can leverage compound interest to their advantage. For example, a parent who invests $3,000 per year in a 529 plan earning 7% annual returns from the time their child is born until they turn 18 would have over $100,000 saved for college.

- Mortgage Payments: Compound interest can also work against you, as seen in the case of mortgage payments. The longer it takes to pay off a mortgage, the more interest you’ll end up paying over the life of the loan. Paying extra principal each month can significantly reduce the total interest paid and the overall cost of the home.

- Credit Card Debt: Compound interest is a double-edged sword when it comes to credit card debt. The high-interest rates charged by credit card companies can lead to a vicious cycle of debt accumulation if not managed carefully. Paying off credit card balances as quickly as possible is crucial to avoid the detrimental effects of compound interest.

Here are two tables to illustrate how compound interest works for investments, one showing annual compounding and the other showing monthly compounding.

Table 1: Annual Compounding

| Year | Initial Principal | Interest Earned | Total Amount |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

| 2 | $1,050 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

| 4 | $1,157.63 | $57.88 | $1,215.51 |

| 5 | $1,215.51 | $60.78 | $1,276.29 |

Table 2: Monthly Compounding

| Month | Initial Principal | Interest Earned | Total Amount |

|---|---|---|---|

| 1 | $1,000 | $4.17 | $1,004.17 |

| 2 | $1,004.17 | $4.18 | $1,008.35 |

| 3 | $1,008.35 | $4.20 | $1,012.55 |

| 4 | $1,012.55 | $4.22 | $1,016.77 |

| 5 | $1,016.77 | $4.24 | $1,021.01 |

| … | … | … | … |

| 60 | – | – | $1,349.35 |

In both tables, we assume an initial principal of $1,000 with an annual interest rate of 5%. The first table shows the growth of the investment with interest compounded annually, while the second table shows the same investment with interest compounded monthly.

These examples illustrate how more frequent compounding periods lead to greater total amounts due to the effect of earning interest on previously earned interest more frequently.

Share Your Expertise, Build Your Business. Tired of limitations?

Create & sell online courses with Teachable. Keep 100% control. Start your free trial!

Conclusion

Compound interest is a powerful financial concept that can significantly accelerate the growth of your investments over time. By understanding how it works, you can leverage this principle to achieve your long-term financial goals, whether that’s saving for retirement, a down payment on a home, or any other investment objective.

Remember, the key to maximizing the benefits of compound interest is to start investing early, maintain a consistent investment strategy, and reinvest your earnings. By doing so, you can harness the exponential power of compound interest and watch your wealth grow steadily over the years.

If you have any questions or need further guidance on how to incorporate compound interest into your investment strategy, don’t hesitate to consult with a qualified financial advisor. They can help you develop a personalized plan to ensure that your money is working hard for you and your financial future.

FAQ: Understanding Compound Interest for Investments

Q1: What is compound interest?

A1: Compound interest is the interest on an investment that is calculated based on both the initial principal and the accumulated interest from previous periods. Essentially, it’s “interest on interest,” which can cause wealth to grow faster compared to simple interest, which is calculated only on the principal amount.

Q2: How is compound interest different from simple interest?

A2: Simple interest is calculated solely on the principal amount for each period. For example, if you invest $1,000 at a 5% annual simple interest rate, you earn $50 every year. Compound interest, on the other hand, adds the interest earned to the principal, so you earn interest on the new total each period. This leads to exponential growth over time.

Q3: How often can interest be compounded?

A3: Interest can be compounded at various intervals, such as annually, semiannually, quarterly, monthly, weekly, or even daily. The more frequently interest is compounded, the more total interest will be earned over time due to the effect of earning interest on previously earned interest.

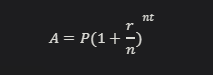

Q4: Can you provide a formula for calculating compound interest?

A4: Yes, the formula to calculate compound interest is:

Where:

- ( A ) is the amount of money accumulated after n years, including interest.

- ( P ) is the principal amount (the initial amount of money).

- ( r ) is the annual interest rate (decimal).

- ( n ) is the number of times that interest is compounded per year.

- ( t ) is the time the money is invested for in years.

Q5: Why does compound interest lead to more growth compared to simple interest?

A5: Compound interest leads to more growth because each period’s interest calculation includes both the initial principal and any accumulated interest from previous periods. This results in a larger base amount for each subsequent calculation of interest, leading to exponential growth over time.

Q6: Is there a downside to compound interest?

A6: While compound interest can significantly grow investments, it can also work against you in scenarios like loans and credit card debt. When borrowing money, compound interest means that not only are you paying interest on the principal amount borrowed but also on the accumulated unpaid interest, which can quickly increase the total amount owed.

Q7: How can I take advantage of compound interest for my investments?

A7: To take advantage of compound interest:

- Start investing early to allow more time for compounding.

- Choose investments that offer compound interest.

- Reinvest your earnings to benefit from compounding.

- Opt for accounts with more frequent compounding periods when possible.

These questions and answers should help clarify how compound interest works and how it can impact your investments.